Courier drivers…

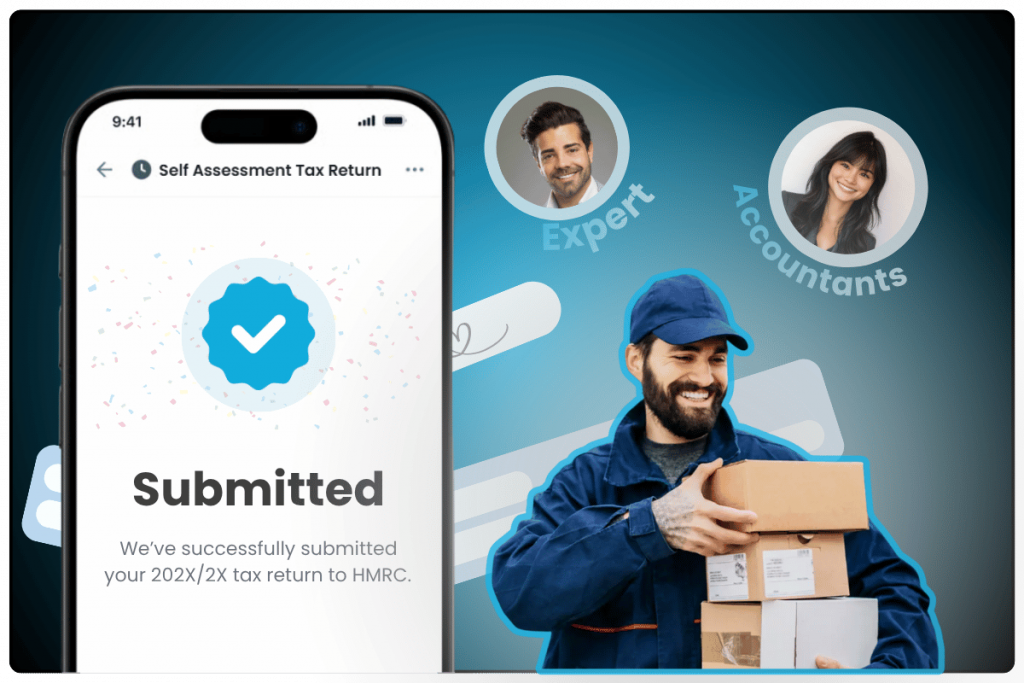

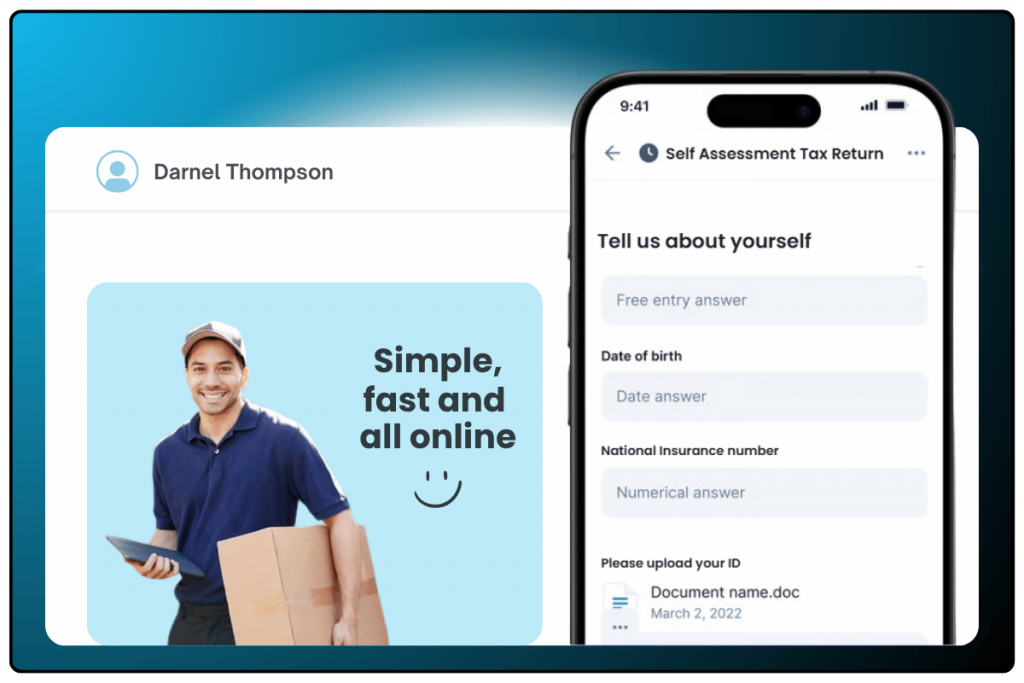

Expert accountants for courier drivers – we’ll handle your taxes from start to finish. Simple, fast, all online.

✔︎ Online accountants

✔︎ Only £15 per week

✔︎ No more tax stress

Imagine a team of expert accountants helping hundreds of courier drivers across the UK with their taxes.

Now imagine an easy-to-use app on your phone – where you can manage your taxes and message your accountants anytime.

Experts accountants, sorting your taxes, from your phone. That’s Taxflex.

Then picture this:

A friendly, UK-based team of accountants handles everything for you – from answering your tax questions to calculating your tax return and filing it with HMRC. We also share money-saving tips and even speak to HMRC on your behalf.

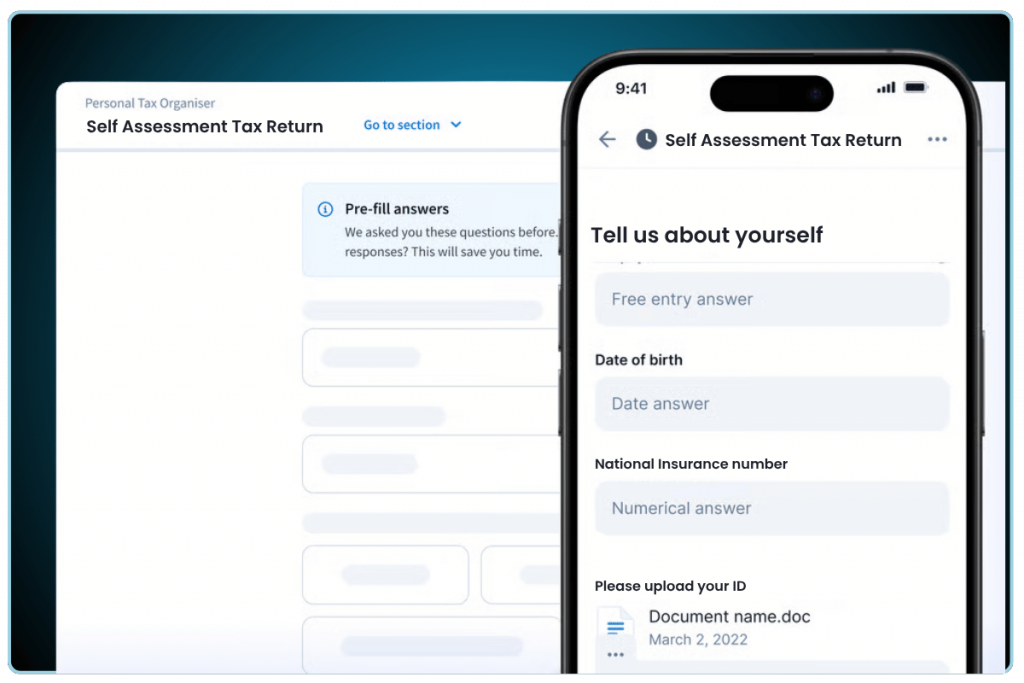

Simply create your account in minutes and download our app.

You’ll be asked a few easy questions, so we know your situation better.

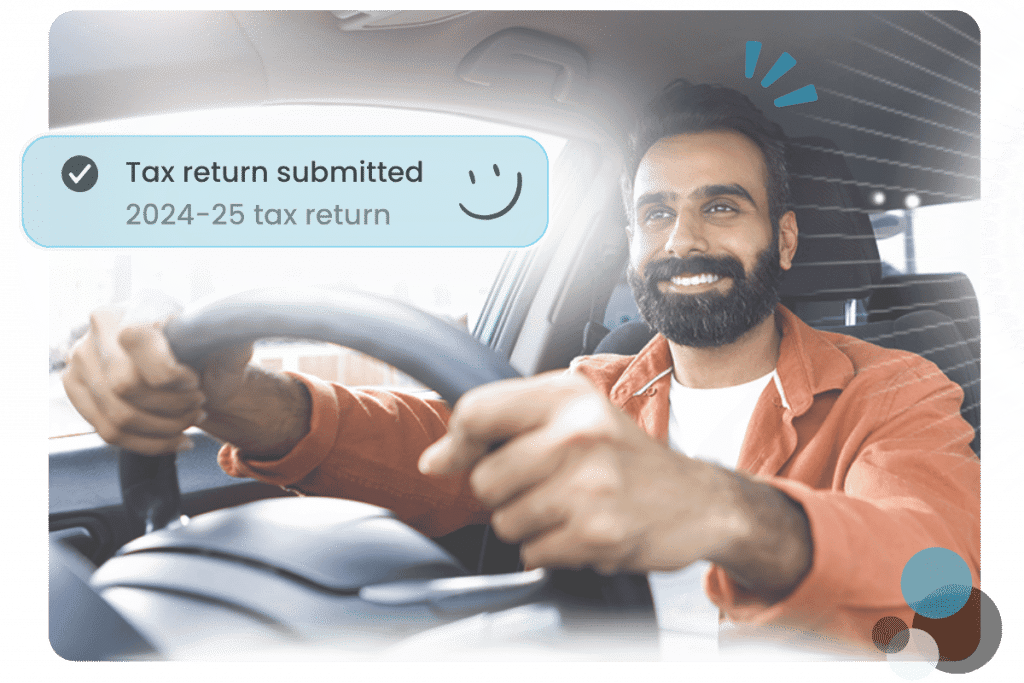

Sit back, we’ll take it from here. As part of our tax service, we’ll speak to HMRC on your behalf, file your taxes, save you money with our tax saving tips. Our friendly team is on hand with any questions you may have.

Same reasons why hundreds of courier drivers, across the UK, choose Taxflex.

Do it anytime, anywhere

No long office visits. With our app, sort your taxes from your phone – on a break, after work, or even in bed.

Flexible

Cancel anytime – no contracts, no hassle.

Easy

We’ve made it simple. Just answer a few questions – we handle all the tax bits.

Simple pricing

Only £15 a week. No hidden fees, no surprises.

Earn more, without extra work

Our tax tips help most drivers make an extra £142.50 a month (on average) – after paying us and HMRC.

We charge a flat fee of £15 per week. Cancel anytime. No hidden fees. No joining fee.

Courier drivers in the UK working for a DSP service, meaning you have planned routes. For example amazon courier drivers.

If you do Amazon flex or similar app based jobs, click here.

Not your average accountants.

Thousands of courier drivers struggle with their taxes, like:

We get it – you drive to earn money, not to worry about taxes.

For over 10 years, we’ve helped courier drivers file their taxes. Many came to us stressed after trying it themselves or even after using an accountant.

Then they tried our simple, easy to use tax service and everything changed.

They saved money, met every tax deadline, and knew their taxes were sorted.

Now, with our fully online service, you can enjoy that same stress-free experience, wherever you are in the UK.

Our expert accountants are helping hundreds of courier drivers and we’re here to make your taxes just as simple.

Not your average accountants.

All online – get started in minutes, message your accountant directly, and manage everything from your phone.

Trusted – hundreds of drivers across the UK use Taxflex.

From your van (or your bed) our step-by-step service is simple to follow at your own pace, all from your phone.

Keep more money in your pocket – we find every allowable expense so you never overpay tax.

Earn more – with our tax tips most drivers earn an extra £142.50 a month after tax and our fees (amounts vary).

Simple pricing – only £15 a week, no hidden fees, no surprises, no hourly charges. Really.

Super easy – just answer a few quick questions and we’ll handle the rest – fast, online, and stress-free.

Simply create your account in minutes, download our app and answer a few questions.

Our tax experts file your taxes, save you money and are ready for questions whenever you need.

Sit back while we handle everything – your tax is officially our job now.

But don’t just take our word for it. Hear what our customers have to say…

Yes.

You can sign up, share your details, and speak to us all through our app or online – perfect for busy schedules.

Sign up today, click “Start Now,” and we’ll get you set up in the app and managing your taxes straight away.

Absolutely. Just click “Start Now” and follow the simple steps – we’ll guide you through everything.

You don’t need to know anything about tax; we’ll ask the right questions, set everything up, and take it from there.

Yes. We guide you through the basics, collect the info we need, and handle the whole process so it’s done correctly and on time.

Yes. When you sign up, just share your current accountant’s details and we’ll handle the handover for you.

Our tax service is £15 per week.

Lucky you! 🌴 While you’re sunning it up, HMRC still wants its paperwork. That’s why we give you two fair options:

1. Full service (£15/week): We handle everything as normal while you’re working.

2. Pause service (£7.50/week): If you’re not working, we keep you compliant – filing any nil returns, watching deadlines, and keeping HMRC happy.

Proof of break: We’ll go by your courier invoices. If there’s no income, you’re on pause. If you’re working, you’re back to full service. Simple.

The pause fee is £7.50 per week. It’s there for when you’re not working as a courier (your courier invoices will show £0 for that period).

We’ll keep you covered with HMRC – filing any nil VAT returns, keeping an eye on deadlines, and making sure nothing slips.

It’s cheaper than the full service and perfect for short breaks. If you’re away longer and cancel completely, you can always re-join later (but that comes with a re-joining fee from £100).

Our service is £15 per week, with a £0 joining fee if you’re signing up to our courier tax service for the first time. Simple, straightforward, and all-in.

We also offer a pause option at £7.50 per week if you take a break from courier work, and a re-joining fee of £100 if you cancel completely and later come back. (More details on this are explained in the FAQs below.)

We like to keep things clear and transparent – no hidden charges, no small print. Everything you need to know about costs is right here in the FAQs.

Absolutely!

We run a no-strings, no-hassle service. If you cancel, we’ll stop acting for you straight away and stop your subscription payments.

The only thing to remember: if you’re VAT registered or still need a Self Assessment tax return, HMRC doesn’t stop just because you do. So, you’ll either need to keep us on, or sort that part yourself.

If it’s only a short break, our pause option (£7.50/week) is usually the smarter move – you’ll save money and still stay fully covered.

You can – but here’s the catch: once you cancel, we completely stop acting for you. That means no VAT returns, no deadline reminders, no safety net.

When you come back, you’ll rejoin as a new customer and pay a rejoining fee (£100 plus any extra fees for overdue VAT returns or Self Assessments).

Think of it like cancelling your van insurance – the cover stops the moment you leave.

If it’s only a short break, our pause option (£7.50/week) is usually the smarter move – you’ll save money and still stay fully covered.

Because HMRC still expects a VAT return every quarter, even if it’s just a big fat “£0”.

Submitting a nil return takes work (and it’s cheaper than HMRC fines). The pause fee (£7.50/week) makes sure you stay fully compliant while paying less than the full service fee.