Online Accountants

Your tax returns don’t need to be painful. We’ll sort it from start to finish. Simple, fast, all online.

✔︎ Stress-free

✔︎ Simple pricing

✔︎ Start right now

Which best describes your work:

You deliver food with with a delivery app (like Just Eat, Uber Eats, and Deliveroo) or with a private takeaway/restaurant?

Option 1

You work directly with parcel companies that provide the van, fuel, insurance, and routes. You’re paid a fixed daily rate for completing deliveries.

For example Amazon DSP, Yodel or DPD.

Option 2

You download an app, choose your own delivery blocks, and complete routes using your own vehicle. No manager or fixed schedule.

For example Amazon flex.

Not your average accountants.

Not your average accountants.

Trusted – hundreds of drivers across the UK use Taxflex.

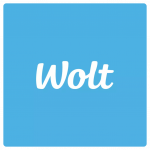

Taxes sorted from your bed. Our step-by-step service is simple to follow at your own pace, all from your phone.

All online – get started in minutes, message your accountant directly, and manage everything from your phone.

Super easy – just answer a few quick questions and we’ll handle the rest – fast, online, and stress-free.

Simple pricing – no hidden fees, no surprises, no hourly charges. Really.

We get it – you drive to earn money, not to worry about taxes.

For over 10 years, we’ve helped drivers file their taxes. Many came to us stressed after trying it themselves or even after using an accountant.

Then they tried our simple, easy to use tax service and everything changed.

They saved money, met every tax deadline, and knew their taxes were sorted.

Now, with our fully online service, you can enjoy that same stress-free experience, wherever you are in the UK.

Our expert accountants are helping hundreds of courier drivers and we’re here to make your taxes just as simple.

No more tax stress. Really.

But don’t just take our word for it. Hear what our customers have to say…

Which best describes your work: